Question: A vendor has sent a reimbursement check or a refund, how do I record this deposit?

Answer: First create a Debit Memo to record the reimbursement. Go to Accounts Payable>Purchase Invoices and Add a new Purchase Invoice.

1) Select the Vendor. 2) Select Debit Memo for the Purchase Invoice Type

3) Select G/L for line type 4) Select the account to post against (optional) if this is a reimbursement for inventory items you may want to select the appropriate inventory item so that it removes it from inventory.

5) Enter the amount (as a negative). IMPORTANT: If you are posting the Debit memo against an inventory item, you will need to put in a negative amount for Pcs/Qty Received and a positive Cost.

6) Post-transaction.

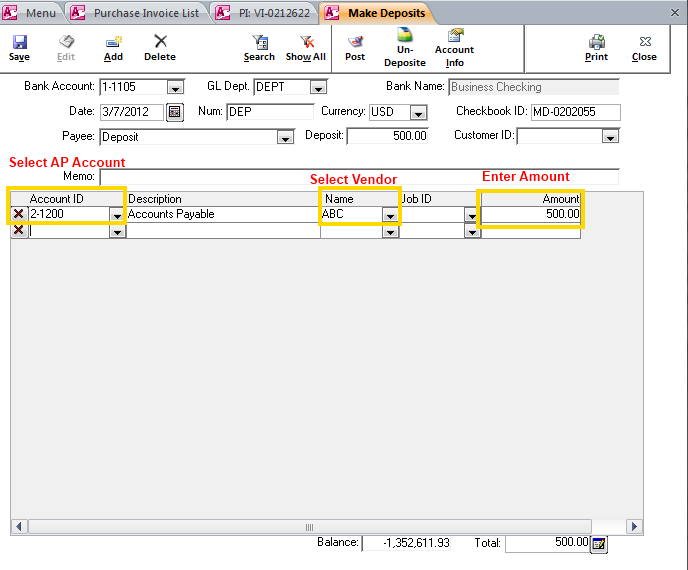

Next, you will add this amount to a Make Deposit (sorry there are not links between the Debit Memo and the Deposit) Banking>Make Deposit and click Add to create a new deposit (this could also be added to an existing deposit)

1) Select the Accounts Payable account 2) Select the Vendor 3) Enter the amount (as a positive number)

4) Post Transaction

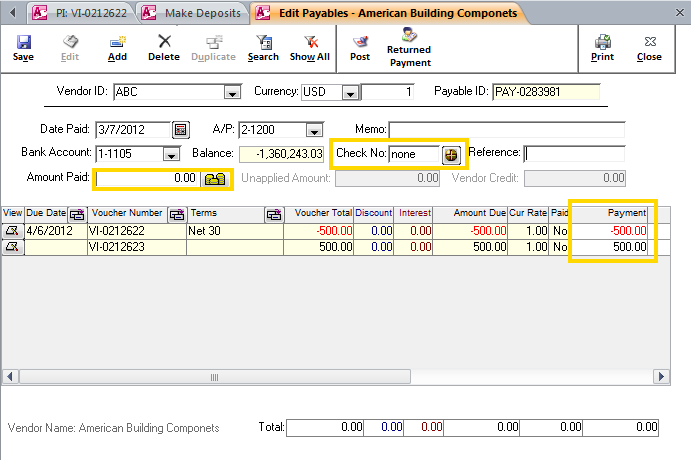

Lastly, you will need to make a Payable to apply the Make Deposit amount to the Debit Memo.

Accounts Payable>Pay Bills and click the Add button to create a new one.

1) Select the Vendor

2) Change the check number to “None”.

3) Pay the full amount of the Debit Memo and the full amount of the balancing transaction from the Make Deposit. (Note: When a transaction such as a Deposit or Journal Entry is posted against an AP or AR account, Paradigm will create a “balancing document”. In this case, a Purchase Invoice is created and it will appear as a regular Purchase Invoice.)

4) Leave the Amount Paid as 0.00

5) Post the transaction

A variation of this process would be when a credit is given to be applied to your account. In this case, you would not create a Deposit, then you would use the Debit Memo to pay on your account with a Payable.